HANGZHOU, China -- (BUSINESS WIRE) --

MYbank, a leading online private commercial bank in China with a focus on SME financing, today announced that the bank’s Star Plan has enabled MYbank, with its financial institution partners, to serve over 15 million small and micro enterprises (SMEs). SMEs are key drivers of economic growth and this partnership is now serving more SMEs than any other in the world. The announcement comes on the day that MYbank celebrates its 4th Anniversary.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190623005055/en/

MYbank’s Star Plan was announced on June 21, 2018 with the aim of using technology to enable 1,000 financial institution partners to provide more cost-effective financing services to 30 million SMEs in China within a three-year period.

A little over a year later and the Star Plan is showing significant progress. As of June 2019, leveraging Alipay’s AI, computing and risk management technologies, MYbank has worked with over 400 financial partners to provide business loans of over RMB 2 trillion (USD 290 billion) to a total of 15.74 million SMEs in China.

“After MYbank had been operational for a year in 2016, we were serving 1.7 million SMEs,” said Simon HU, Chairman of MYbank. “Today we serve over 15 million SMEs by combining our strength in risk management technologies with the capital support of our financial institution partners. As the Star Plan progresses, we look forward to increasing the inclusivity of financial services for SMEs by sharing our technologies with more financial institution partners.”

According to China’s State Administration for Market Regulation, as of July 2017, there were approximately 73 million SMEs in China, but this large market that has the potential to drive economic growth is not receiving the financial support it needs. Toward Universal Financial Inclusion in China, a joint report published by the People’s Bank of China (PBOC) and the World Bank in 2018, found that only 14% of China’s small businesses have access to loans or line of credit, compared to an average of 27% of small businesses across all G20 countries. The report highlights a number of reasons why SMEs do not apply for credit including a complex application process, perceived high costs associated with obtaining a loan, an inability to obtain sufficient loan size and maturity, as well as a long review and approval period.

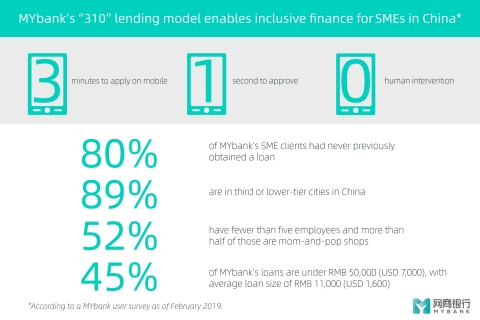

MYbank pioneered the “310 model” for SME financing which offers a collateral-free business loan that takes less than three minutes to apply for on a mobile phone, less than one second to approve and requires zero human intervention. Using proprietary AI and risk management technologies, the non-performing loan (NPL) ratio for MYbank’s SME business loans has consistently been at around 1%. As of March 2018, the average NPL for SME loans in China was 2.75%, according to the PBOC.

According to PBOC, SMEs refers to businesses with a line of credit below RMB 10 million (USD 1.5 million). The average line of credit that MYbank extended to SMEs stands at RMB 30,000 (USD 4,400) as of June, 2019.

About MYbank

With a focus on serving SMEs and farmers, MYbank was established on June 25th, 2015 and was among the first batch of pilot private commercial banks in China. It was also the first bank in China to establish its core banking system entirely on the cloud without any physical branches. As one of the brands under Ant Financial Services Group, MYbank leverages Alipay’s AI, computing and risk management technologies to improve customer service and increase efficiency. MYbank’s efficient operating model enables it to reduce the costs for its partner financial institutions.

Using a comprehensive AI-powered risk management system, which comprises of over 100 predicative models, 3,000 risk profiles and more than 100,000 metrics, MYbank calculates an appropriate line of credit for SMEs that minimizes the risk of excessive lending. As a result, the non-performing loan (NPL) ratio for MYbank’s SME business loans has consistently been at around 1%. As of March 2018, the average NPL for SME loans in China was 2.75%, according to the PBOC.

As of June 2019, MYbank has provided micro loans totaling over RMB 2 trillion (USD 290 billion) to over 15.74 million small and micro enterprises and entrepreneurs in China. The size of each loan is around RMB 10,000 (USD 1,500), reflecting the inclusive nature of MYbank business loans.

For more details of the Star Plan, please refer to our official website: MYbank launches Star Plan to support 1,000 financial institutions to serve 30 million SMEs in the next three years

About Alipay

Operated by Ant Financial Services Group, Alipay is the world’s leading payment and lifestyle platform. Launched in 2004, Alipay currently serves over 1 billion users with its local e-wallets partners. Over the years, Alipay has evolved from a digital wallet to a lifestyle enabler. Users can hail a taxi, book a hotel, buy movie tickets, pay utility bills, make appointments with doctors, or purchase wealth management products directly from within the app. In addition to online payments, Alipay is expanding to in-store offline payments both inside and outside of China. Alipay’s in-store payment service covers over 50 countries and regions across the world, and tax reimbursement via Alipay is supported in 35 countries and regions. Alipay works with over 250 overseas financial institutions and payment solution providers to enable cross-border payments for Chinese traveling overseas and overseas customers who purchase products from Chinese e-commerce sites. Alipay currently supports 27 currencies.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190623005055/en/

CONTACT:

Media Inquiries

Le SHEN (Mr.)

Alipay / MYbank

Email: shenle.sl@antfin.com

Mobile: +86 139 1046 7197

MYbank’s 310 lending model enables inclusive finance for SMEs in China (Photo: Business Wire)

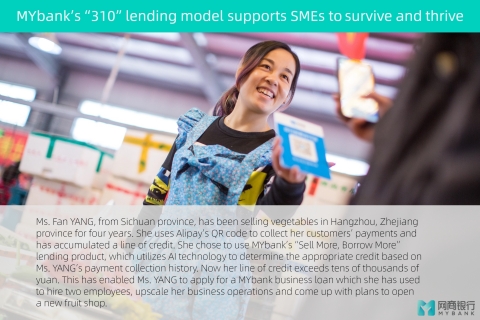

MYbank’s 310 lending model supports SMEs to survive and thrive (Photo: Business Wire)