PARIS--(BUSINESS WIRE)--Tinubu Square, a leading provider of credit insurance, surety and trade finance solutions, is launching today the Tinubu Bonding Insurance Suite (BIS), which has been developed to serve the surety bonding needs of insurers. The new product is a natural extension of Tinubu Square’s SaaS-based, end-to-end enterprise platform, used widely to help the industry manage and develop its international trade credit insurance, and now its surety bonding activities.

The new Tinubu BIS is designed to support surety carriers in their digital transformation journey and to help them to adopt the technologies they need to become more agile and enhance their value proposition to customers.

It draws on Tinubu Square’s long-standing experience delivering solutions that enable insurers to administer the lifecycle of their products from commercial and risk underwriting to claims payment. The same dedication to improving visibility and delivering results has been written into the Bonding Insurance Suite. This will give insurers optimum time to market in what is often a fast moving environment requiring innovative risk distribution strategies. The new solution will allow them to manage an increasing number of bond wordings and signature processes.

Olivier Placca, Tinubu Square Deputy CEO, said: “Tinubu has grown a large and loyal customer base amongst international insurance companies. So, it has become incumbent on us to provide cutting-edge solutions that will support the industry’s business models profitably while helping insurers manage customer-focused strategies. The Bonding Insurance Suite is an extension of our existing, proven software, so it offers opportunities to digitize transactions and take advantage of data assets. It will also ensure that companies are equipped for fluctuating regulations and the particular demands of operating in multiple geographical locations. We have built our considerable knowledge and technical know-how into this new suite and this will be to the advantage of the surety bonding sector during the challenges they face in their digital transformation.”

Key features of the Tinubu Bonding Insurance Suite include:

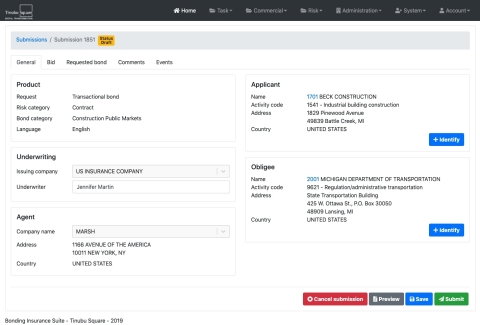

- Administration – The capability to manage users, their permissions and authorities within the system. Organisational changes and new staff on-boarding can be easily managed with the profile management tool. Products and their parameters can be created and administered in defined bond categories and associated to bond wordings in the bond library. The suite also includes repository of intermediaries and financial counter-parties to help manage the distribution and production network.

- Commercial Underwriting – The central repository allows financial statements to be edited or uploaded in Tinubu’s proprietary pivot format and to interface with data providers. Bonding facilities and single bond submissions can be swiftly created, and users will find all the necessary information to manage their customer relationships efficiently.

- Risk Underwriting – All submission, customer data and diary records are easily accessed, including past assessments and decisions. Thanks to the pdf generator, decision making support material can be created and archived. Dedicated features in the suite allow exposure at the customer level to be aggregated and construction contract execution to be monitored while analysis can be performed across portfolios thanks to Tinubu’s structured data capture of customer, obligee and intermediary information.

User Experience Benefits: Forms and applications can be easily imported into the application and files uploaded in a variety of format using drag and drop. Tinubu has also embedded a diary to centralise documents and archive communications at various levels. Insurers will find that they can give access to their international teams in one single solution available in English, French and Spanish.

About Tinubu Square

Founded in 2000, Tinubu Square is a software vendor, enabler of the Credit Insurance, Surety and Trade Finance digital transformation. Tinubu Square enables organizations across the world to significantly reduce their exposure to risk and their financial, operational and technical costs with best-in-class technology solutions and services. Tinubu Square provides SaaS solutions and services to different businesses including credit insurers, receivables financing organizations and multinational corporations. Tinubu Square has built an ecosystem of customers in over 20 countries worldwide and has a global presence with offices in Paris, London, New York, Montreal and Singapore. For more information: www.tinubu.com