Strong demand, increased earnings and margin support a robust cash flow

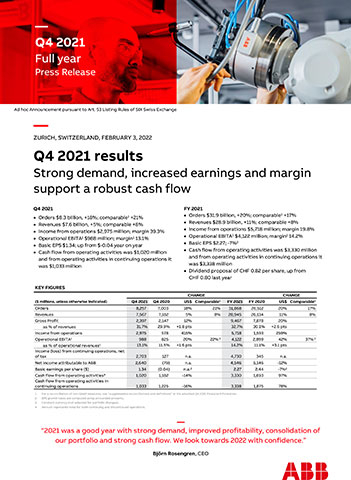

Q4 2021

Orders $8.3 billion, +18%; comparable1 +21%

Revenues $7.6 billion, +5%; comparable +8%

Income from operations $2,975 million; margin 39.3%

Operational EBITA1 $988 million; margin1 13.1%

Basic EPS $1.34; up from $-0.04 year on year

Cash flow from operating activities was $1,020 million and from operating activities in continuing operations it was $1,033 million

FY 2021

Orders $31.9 billion, +20%; comparable1 +17%

Revenues $28.9 billion, +11%; comparable +8%

Income from operations $5,718 million; margin 19.8%

Operational EBITA1 $4,122 million; margin1 14.2%

Basic EPS $2.27; -7%2

Cash flow from operating activities was $3,330 million and from operating activities in continuing operations it was $3,338 million

Dividend proposal of CHF 0.82 per share, up from CHF 0.80 last year

Ad hoc Announcement pursuant to Art. 53 Listing Rules of SIX Swiss Exchange

ZURICH -- (BUSINESS WIRE) --

ABB (SWX:ABBN):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220202005919/en/

|

KEY FIGURES |

|

|

|

|

|

|

|

|

|

|

|

|

CHANGE |

|

|

CHANGE |

||

|

($ millions, unless otherwise indicated) |

Q4 2021 |

Q4 2020 |

US$ |

Comparable1 |

FY 2021 |

FY 2020 |

US$ |

Comparable1 |

|

Orders |

8,257 |

7,003 |

18% |

21% |

31,868 |

26,512 |

20% |

17% |

|

Revenues |

7,567 |

7,182 |

5% |

8% |

28,945 |

26,134 |

11% |

8% |

|

Gross Profit |

2,397 |

2,147 |

12% |

|

9,467 |

7,878 |

20% |

|

|

as % of revenues |

31.7% |

29.9% |

+1.8 pts |

|

32.7% |

30.1% |

+2.6 pts |

|

|

Income from operations |

2,975 |

578 |

415% |

|

5,718 |

1,593 |

259% |

|

|

Operational EBITA1 |

988 |

825 |

20% |

22% 3 |

4,122 |

2,899 |

42% |

37% 3 |

|

as % of operational revenues1 |

13.1% |

11.5% |

+1.6 pts |

|

14.2% |

11.1% |

+3.1 pts |

|

|

Income (loss) from continuing operations, net of tax |

2,703 |

127 |

n.a. |

|

4,730 |

345 |

n.a. |

|

|

Net income attributable to ABB |

2,640 |

(79) |

n.a. |

|

4,546 |

5,146 |

-12% |

|

|

Basic earnings per share ($) |

1.34 |

(0.04) |

n.a.2 |

|

2.27 |

2.44 |

-7%2 |

|

|

Cash flow from operating activities4 |

1,020 |

1,182 |

-14% |

|

3,330 |

1,693 |

97% |

|

|

Cash flow from operating activities in continuing operations |

1,033 |

1,225 |

-16% |

|

3,338 |

1,875 |

78% |

|

“2021 was a good year with strong demand, improved profitability, consolidation of our portfolio and strong cash flow. We look towards 2022 with confidence.”

Björn Rosengren, CEO

CEO summary

In the fourth quarter, demand increased significantly and orders grew by 18% year-on-year (21% comparable) with underlying strength shown across all business areas, regions and most customer segments. Revenue growth of 5% (8% comparable) was stronger than expected, due primarily to higher project deliveries towards the end of the period and despite supply chain disruptions in parts of our business. We expect supply chain constraints to prevail near-term. Importantly, we did not experience any unusual order cancellations, which adds comfort to the high level of order backlog of $16.6 billion, up 16% year-on-year (21% comparable).

Operational EBITA increased by 20% year-on-year, and despite adverse impacts from supply chain imbalances and some cost inflation we achieved a 160bps improvement of the Operational EBITA margin to 13.1%. This improvement includes last year’s adverse margin impact of 80bps due to the charges triggered by the Kusile project in South Africa as well as non-core items.

At $1.0 billion we maintained a strong cash generation in the fourth quarter, and I am pleased with us closing 2021 with a total cash flow from operating activities in continuing operations of $3.3 billion, representing an annual improvement of $1.5 billion.

We successfully closed the divestment of the Mechanical Power Transmission (Dodge) division on November 1. This triggered a book gain of $2.2 billion reported in income from operations. This marks the completion of the announced first step to focus the business portfolio on our leading position in electrification and automation. As part of these actions, we have appointed a new Head of the Turbocharging division and while a spin-off looks more likely, we will make a final decision towards the end of the first quarter. Meanwhile, efforts to separately list the E-mobility business are moving ahead and we aim to complete this during the second quarter 2022.

On the back of added confidence for our future growth and profitability, we lifted our long-term targets at our Capital Markets Day in December. Our leading position in resource efficiency through electrification and automation, new ways of working through the decentralized operating model, improved performance management system and acceleration of ESG drivers are expected to drive our through-the-cycle revenue growth to 4-7%, in constant currency. This is the total of 3-5% organic growth and 1-2% acquired growth. We also sharpened our Operational EBITA margin target to be at least 15% as from 2023, in any given year.

We firmed up our ambition to drive industry leadership in circularity. By 2030, the goal is to have 80% of ABB products and solutions covered by our common approach for circular customer solutions and circularity in our own operations.

To support our growth ambitions and leading offering, we invested in start-up company BrainBox AI which pioneers the use of artificial intelligence to reduce energy costs and carbon emissions from Heating, Ventilation and Air Conditioning (HVAC) systems in commercial buildings. Additionally, we entered into a strategic partnership with start-up Sevensense, to enhance our new autonomous mobile robotics (AMR) offering with artificial intelligence and 3D vision mapping technology.

After the close of the quarter, the E-mobility division took action to strengthen its position on the US market as it increased its stake to a controlling 60% in InCharge Energy. InCharge Energy tailors end-to-end EV charging infrastructure solutions, including the procurement, installation, operation, and maintenance of charging systems, and provides cloud-based software services to optimize energy management.

Considering improving performance, strong cash flow and robust balance sheet, the Board of Directors proposes an ordinary dividend of CHF 0.82 per share. Up from CHF 0.80 in the previous year and in line with the long-term ambition of a rising sustainable dividend per share over time, while still prioritizing a continued solid balance sheet to support our growth ambitions. We plan to continue our share buybacks for full year of 2022, also in excess of the PG capital return program.

Björn Rosengren

CEO

Outlook

In the first quarter of 2022, ABB anticipates the underlying market activity to remain overall stable compared with the prior quarter. Revenues in the first quarter tend to be sequentially seasonally softer in absolute terms. ABB anticipates the Operational EBITA margin to remain broadly stable or to be slightly up, compared with the prior quarter.

In full year 2022, we expect a steady margin improvement towards the 2023 target of at least 15%, supported by increased efficiency as we fully incorporate the decentralized operating model and performance culture in all our divisions. Furthermore, we expect support from an anticipated positive market momentum and our strong order backlog.

The complete press release including the appendices is available at www.abb.com/news.

ABB (ABBN: SIX Swiss Ex) is a leading global technology company that energizes the transformation of society and industry to achieve a more productive, sustainable future. By connecting software to its electrification, robotics, automation and motion portfolio, ABB pushes the boundaries of technology to drive performance to new levels. With a history of excellence stretching back more than 130 years, ABB’s success is driven by about 105,000 talented employees in over 100 countries.

|

1 |

For a reconciliation of non-GAAP measures, see “supplemental reconciliations and definitions” in the attached Q4 2021 Financial Information. |

|

|

2 |

EPS growth rates are computed using unrounded amounts. |

|

|

3 |

Constant currency (not adjusted for portfolio changes). |

|

|

4 |

Amount represents total for both continuing and discontinued operations. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220202005919/en/

CONTACT:

ABB Ltd

Affolternstrasse 44

8050 Zurich

Switzerland

Media Relations

Phone: +41 43 317 71 11

E-mail: media.relations@ch.abb.com

or

Investor Relations

Phone: +41 43 317 71 11

E-mail: investor.relations@ch.abb.com

ABB: Q4 2021 Results