Solid performance in an uncertain environment

ZURICH -- (BUSINESS WIRE) --

Ad hoc Announcement pursuant to Art. 53 Listing Rules of SIX Swiss Exchange

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220420006098/en/

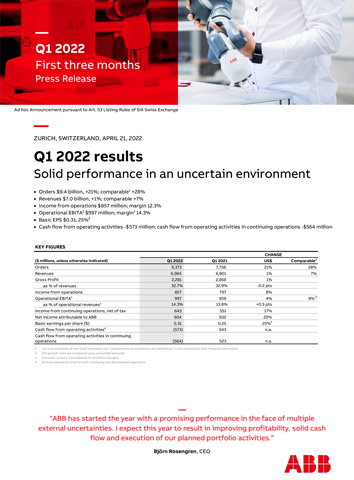

- Orders $9.4 billion, +21%; comparable1 +28%

- Revenues $7.0 billion, +1%; comparable +7%

- Income from operations $857 million; margin 12.3%

- Operational EBITA1 $997 million; margin1 14.3%

- Basic EPS $0.31; 25%2

- Cash flow from operating activities -$573 million; cash flow from operating activities in continuing operations -$564 million

|

KEY FIGURES |

|

|

|

|

|

|

|

|

CHANGE |

|

|

($ millions, unless otherwise indicated) |

Q1 2022 |

Q1 2021 |

US$ |

Comparable1 |

|

Orders |

9,373 |

7,756 |

21% |

28% |

|

Revenues |

6,965 |

6,901 |

1% |

7% |

|

Gross Profit |

2,281 |

2,268 |

1% |

|

|

as % of revenues |

32.7% |

32.9% |

-0.2 pts |

|

|

Income from operations |

857 |

797 |

8% |

|

|

Operational EBITA1 |

997 |

959 |

4% |

8% 3 |

|

as % of operational revenues1 |

14.3% |

13.8% |

+0.5 pts |

|

|

Income from continuing operations, net of tax |

643 |

551 |

17% |

|

|

Net income attributable to ABB |

604 |

502 |

20% |

|

|

Basic earnings per share ($) |

0.31 |

0.25 |

25%2 |

|

|

Cash flow from operating activities4 |

(573) |

543 |

n.a. |

|

|

|

||||

|

Cash flow from operating activities in continuing operations |

(564) |

523 |

n.a. |

|

|

1. |

For a reconciliation of non-GAAP measures, see “supplemental reconciliations and definitions” in the attached Q1 2022 Financial Information. |

|

2. |

EPS growth rates are computed using unrounded amounts. |

|

3. |

Constant currency (not adjusted for portfolio changes). |

|

4. |

Amount represents total for both continuing and discontinued operations. |

“ABB has started the year with a promising performance in the face of multiple external uncertainties. I expect this year to result in improving profitability, solid cash flow and execution of our planned portfolio activities.”

Björn Rosengren, CEO

CEO summary

In the first quarter, we witnessed the start of the war in Ukraine – a human tragedy – and consequently one of our key priorities was to ensure the safety and wellbeing of our people. In an effort to support the people of Ukraine, we have made a significant donation to the International Committee of the Red Cross. Prior to suspending the intake of any new orders in Russia it represented only 1-2% of ABB revenues.

Customer activity was strong throughout the quarter, resulting in the very high order growth of 21% year-on-year (28% comparable). Most major customer segments and regions developed favorably and three out of four business areas reported high double-digit growth. Notably, the high order intake was driven by high general customer activity and not by large orders, and includes a de-booking of approximately $190 million in Process Automation.

We saw an increase in revenues which improved by 1% (7% comparable), supported by a positive development in all business areas except for Robotics & Discrete Automation, which was hampered by component shortages. The order backlog increased to $18.9 billion at the end of the period, up by 28% year-on-year (32% comparable). The zero-Covid strategy in China had no material impact on our ability to fulfill customer deliveries in the first quarter. That said, we are monitoring the situation and although difficult to quantify, we do not rule out somewhat of an adverse near-term impact on operations due to the local lock-downs.

In total, we achieved an Operational EBITA margin of 14.3%. Due to the support from higher volumes and successful pricing activities we managed to offset the adverse impacts from cost inflation, primarily related to raw materials, certain components, logistics and tight labor markets. In addition, the result was supported by low costs in Corporate & Other. As a reminder, last year’s Operational EBITA margin of 13.8%, was positively impacted by 30 basis points from the recently divested Mechanical Power Transmission business. Looking at the underlying operations, I am pleased that we were able to slightly improve the Operational EBITA margin in the current environment of inflation and strained value chain. This reflects that our hard work towards increased accountability, transparency and speed is yielding results.

Cash flow from operating activities, amounted to -$573 million. As expected, it declined compared with last year, but the drop was sharper than anticipated due primarily to a higher-than-expected build-up of net working capital, to support deliveries from the order backlog. Cash delivery will clearly be in focus going forward and I expect a solid full-year cash flow.

We made overall good progress towards our 2030 sustainability goals in 2021, as publicized in our Sustainability Report in March. As an example, we reduced our own CO2e emissions by 39%, from the 2019 baseline. Additionally, our products, services and solutions sold last year will enable our customers to reduce their CO2e emissions by 11.5 megatons after the first year, which is a good start towards our target of more than 100 megatons by 2030.

We made progress with the portfolio activities. We plan for an exit of the Turbocharging business, although the geo-political uncertainties caused us to delay the final decision on a spin-off or sale to the second quarter. Preparing for the separation, we launched the new company name and brand – Accelleron. For the E-mobility business, our plan for a separate listing during the second quarter remains intact, assuming constructive market conditions.

I look forward to the impacts of the leadership exchange in Electrification and Motion. I have great confidence in both Tarak and Morten and expect them to continue to improve operational performance for both growth and profitability. The change was effective as of April 1.

Finally, I am pleased we announced a continuation of share buybacks of up to $3 billion, including the fulfillment of the promise to return the remaining $1.2 billion of proceeds related to the divestment of Power Grids. This new buyback program was launched on April 1.

Björn Rosengren

CEO

Outlook

In the second quarter of 2022, ABB anticipates the underlying market activity to remain broadly similar compared with the prior quarter. Revenues in the second quarter tend to be sequentially stronger in absolute terms, supporting a slight sequential margin increase, assuming no escalation of lock-downs in China.

In full-year 2022, we expect a steady margin improvement towards the 2023 target of at least 15%, supported by increased efficiency as we fully incorporate the decentralized operating model and performance culture in all our divisions. Furthermore, we expect support from an anticipated positive market momentum and our strong order backlog.

The complete press release including the appendices is available at www.abb.com/news.

ABB (ABBN: SIX Swiss Ex) is a leading global technology company that energizes the transformation of society and industry to achieve a more productive, sustainable future. By connecting software to its electrification, robotics, automation and motion portfolio, ABB pushes the boundaries of technology to drive performance to new levels. With a history of excellence stretching back more than 130 years, ABB’s success is driven by about 105,000 talented employees in over 100 countries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220420006098/en/

CONTACT:

ABB Ltd

Affolternstrasse 44

8050 Zurich

Switzerland

Media Relations

Phone: +41 43 317 71 11

Email: media.relations@ch.abb.com

Investor Relations

Phone: +41 43 317 71 11

Email: investor.relations@ch.abb.com